We use cookies and similar technologies to enhance your experience. By clicking “Accept All,” you agree to the use of all cookies detailed in our Privacy Policy You can manage your preferences or withdraw your consent at any time

What is Customer Acquisition Cost & How to Calculate It

Seeing that you are acquiring a good amount of customers is great. But is it really that great if you spend more than you gain? If you do, that would mean you are acquiring customers at your business’s cost. Understanding your customer acquisition cost (CAC) and seeing how much a customer will cost you is vital to your business and your marketing decisions.

Key Takeaways

- Customer acquisition cost is how much you spend to acquire a customer.

- A lower CAC indicates higher revenue and higher profit for a business.

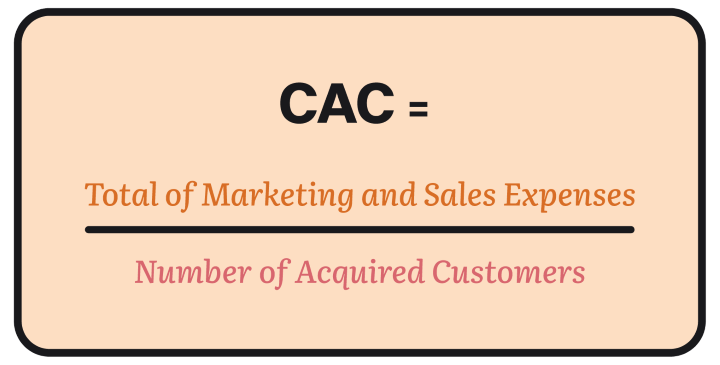

- A simple formula to calculate CAC: CAC = Total of Marketing and Sales Expenses / Number of Acquired Customers

What is Customer Acquisition Cost (CAC)?

Customer acquisition cost is simply the amount of how much you pay to acquire a customer. It’s not only about the advertising cost, though. This cost includes all marketing and sales expenses associated with the efforts of converting a prospect into a paying customer.

How to Calculate CAC?

It can be found by dividing the total costs by the number of acquired customers.

The most straightforward formula to find customer acquisition cost is as follows:

Note that there are some things to consider and not to exclude when calculating CAC. Ad spend, salaries of marketing and sales team, the cost of tools used, production costs and other things that are easy to overlook but actually add up to the overall cost, such as rental and equipment costs.

What Does Customer Lifetime Value (CLV) Have to Do with CAC?

Another way of understanding if the money you spend on customer acquisition is worth it is knowing your customer lifetime value.

CLV is basically the total amount of revenue a customer has generated for a business. It itself is a crucial measurement to understand the success of a business. But together with CAC, you get a clearer result regarding the profit you get in the end.

The ideal ratio of CLV to CAC is 3:1, which means you get 3 times more for each dollar you spend. Any result above that ratio is considered to be a good result for a business. And, whatever the ratio you get is, it certainly tells you a lot about your business and what kind of road map you should draw.

Read this expansive guide to learn how to calculate customer lifetime value and why it is so important for any business: How to Calculate Customer Lifetime Value

Benefits of Lower CAC

Lower CAC means you earn more than you spend to acquire a new customer. In other words, it indicates higher revenue and higher profit. Converting leads into customers with the lowest cost possible is one of the most beneficial outcomes of your marketing efforts.

How to Reduce Your CAC?

Before investing further into customer acquisition and optimising CAC, you first need to understand what you need and which strategy will work best for you. Fast growing? Growth in the long run? High revenue?

If you want fast growth, the advertisements will surely bring you many leads, but it is up to the quality of your service and your marketing program to convert prospects and retain customers.

Customer engagement is of high importance to provide a good conversion rate. Get in touch with your customers through multiple channels and determine the most effective. For example, you might attract more customers with your blogs rather than giving paid ads, or vice versa.

Having satisfied customers who will recommend and advocate for you is one of the best ways to acquire new customers. What’s better is that it won’t cost you anything!

How Can You Use the CAC Data?

As already mentioned, CAC gives you a number and an opportunity to have an insight into your current marketing strategies and profits. Then, CAC can be used to make better marketing decisions and increase profitability.